Our Function & Role #

The Financial Services Authority was created on November 12, 2012, through the Financial Services Authority Act. This act set up a single organization to oversee specific businesses in the financial sector and manage regulated issues. Parliament established the Authority to create a new system for managing and supervising both the international financial services industry and local non-bank institutions. This organization merged three regulatory bodies: the International Financial Services Authority (IFSA), the Co-operatives Division of the Ministry of National Mobilization, Social Development, and the Supervisory and Regulatory Division within the Ministry of Finance. This merger has brought significant benefits by improving operations, consolidating resources, and boosting efficiency.

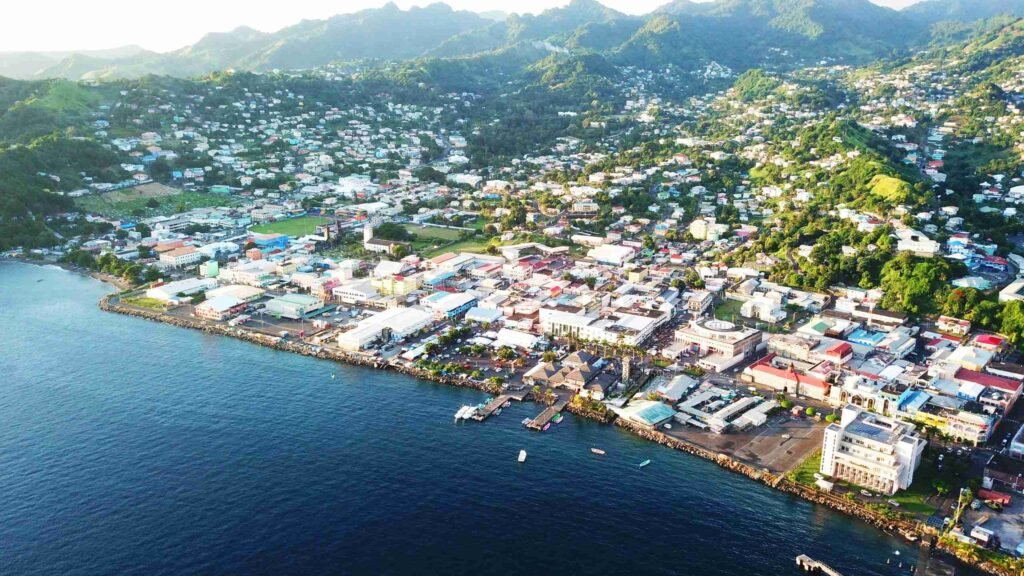

The Financial Services Authority Act, No. 33 of 2011 clearly outlines the role of the Authority. A board of directors oversees its operations. The FSA’s mission comes from its legal objectives. According to the Financial Services Authority Act, No. 33 of 2011, the FSA is authorized to manage, supervise, and grow the non-bank financial services sector in St. Vincent and the Grenadines.

The FSA is accountable to the Government of St. Vincent and the Grenadines for managing and enforcing the laws listed in its governing legislation. To fulfill its role, the FSA ensures compliance with the FSA Act and other relevant laws, regulations, or guidelines. It also makes sure that each licensed financial entity is well-managed and financially stable. The FSA has the authority to intervene in the operations of a regulated entity to protect customers.

The FSA provides efficient and professional service to the IFS and non-banking financial services sectors. The setup of international business companies, limited liability companies, and international trust registrations can be completed in one business day. All international business transactions are carried out through a ‘Registered Agent & Trustee’. The Registered Agents & Trustees are licensed and regulated by the Authority under rules established by the Registered Agent Trustee (Licensing) Act, Chapter 105 of the Revised Laws of St. Vincent and the Grenadines 2009.

The FSA also seeks to provide timely and reliable information on international initiatives that affect the financial services sector. The Authority represents the Minister of Finance on various international initiatives, including those from the OECD.

Supervisory approach #

The FSA’s role is to oversee and regulate non-bank financial entities, promoting stability, public awareness, and confidence in these licensed operators. The FSA uses a risk-based approach to ensure that these institutions are effectively supervised and that potential threats and risks are promptly identified and addressed.

The FSA also employs internationally recognized prudential standards to evaluate the financial health and stability of the institutions it oversees (IFRS, CAMELS, PEARLS, BASEL I, and some aspects of BASEL II, IACS-ICPs).

The FSA is focused on enhancing financial stability to guarantee that institutions are properly supervised and that new threats and risks are swiftly recognized and managed. A stable financial system is essential for achieving other goals like maintaining market confidence, protecting consumers, and minimizing financial crime.

The FSA frequently monitors an institution’s financial and operational status to ensure compliance with the minimum prudential requirements set by relevant laws. These tasks are mainly conducted through off-site surveillance and on-site inspections. Off-site supervision involves reviewing regulatory reports and financial statements and conducting periodic trend analysis of selected ratios.

The on-site inspection involves assessing the qualitative risks that cannot be assessed offsite. On-site assessment aims at verifying the compliance with the requisite laws and regulations. It is the cornerstone of the supervisory process and involves the evaluation of an institution’s corporate governance through interviews with management, inspecting the written policies and procedures of the institution and the degree to which those written policies and procedures are followed, evaluating whether the institution’s financial statements accurately show the profitability and capital, checking the accuracy of accounting records, evaluating the adequacy of internal controls and the audit function as well as looking at investments and the risk appetite of the company.

On-site and Offsite supervision are mutually reinforcing and are designed to rapidly identify and diagnose emerging problems in individual institutions with a view to prescribing the most efficient resolution directed towards ensuring continued public confidence in the financial system.

The FSA receives technical support and/or is a member of the following: #

-

- ECCB – Eastern Caribbean Central Bank

- CARTAC – Caribbean Regional Technical Assistance Centre

- CFATF – Caribbean Financial Action Task Force

- CAIR – Caribbean Association of Insurance Regulators

- CGBS – Caribbean Group of Banking Supervisors

- CAPS – Caribbean Association of Pension Supervisors

- CACS – Caribbean Association of Credit Union Supervisors

- OECD – Organisation for Economic Co-operation and Development

- IMF – International Monetary Fund

- Commonwealth Secretariat – http://thecommonwealth.org/

- World Bank – http://www.worldbank.org/

- Other regional and international regulators

Executive Summary #

The Financial Services Authority (‘FSA’) was established on November 12th 2012 as an autonomous statutory body pursuant to provisions of the Financial Services Authority Act, No. 33 of 2011 (‘the FSA Act’).

The FSA was established for the purpose of regulating the international (offshore) financial and non-bank financial sectors, the latter comprising Credit Unions, Insurances, Pensions, Building Societies, Friendly Societies and Money Remitters.

The establishment of the FSA in 2012 was a regulatory development of historic significance to St. Vincent and the Grenadines, as it brought together an amalgam of different regulatory entities into a single regulatory body, which was unprecedented. Such constitution has yielded substantial benefits by consolidating resources and optimizing efficiencies.

The FSA’s role, functions and powers are outlined in the FSA Act and its regulatory objectives are enshrined in the FSA’s core guiding principles, also outlined therein. These include, in sum, the protection and fair treatment of consumers, the enhancement of market integrity and financial stability, and the promotion of fair competition. The FSA’s core role is to administer the provisions of the FSA Act and all other relevant enactments. Its core function is to supervise the operations of financial entities to promote compliance with their respective governing legislation and other applicable law, including the anti-money laundering (AML) and counter financing of terrorism (CFT) laws of this country. The FSA goes a step further to promote not only compliance with the law but international best practices.

The FSA Act equips the FSA with appropriate powers to be able to effectively carry out its functions and captures best international regulatory and supervisory practices. Its provisions address internationally accepted requirements of the FATF on AML and CFT, and that of the OECD on tax transparency, in key areas such as regulatory access to information and sanctioning powers available to regulators. The FSA Act bolsters existing exchange of information provisions in sector specific legislation, as well as the Exchange of Information Act. The mettle of this Act has withstood one of the highest regulatory tests in the form of intervention and assumption of administrative control of a major financial institution, without the need for a lengthy court process.

Apart from having a comprehensive legislated mandate and apposite regulatory powers, the FSA in its very early stages developed an appropriate accompanying administrative framework to properly discharge its functions. The FSA is staffed by a cadre of qualified multi-disciplinary professionals with relevant legal, financial, accounting and regulatory backgrounds. It is governed by an independent Board of Directors with requisite qualifications and experience in keeping with statutorily stipulated requirements. It is also well buttressed by technical assistance from the Caribbean Regional Technical Assistance Centre (CARTAC), an IMF Funded technical assistance organization.

Over the past years, the FSA has forged full speed ahead to evolve into a professional and specialized organization, engaged in the responsible execution of its legal mandate. It has utilized wide ranging regulatory powers to undertake various regulatory and empowerment actions to foster compliance with governing legislation and to promote stability in the operations of financial entities. #

The FSA urges that each member of the regulated sector ensures that it is well positioned to easily demonstrate its accountability as well as its integrity, to its consumers, stakeholders (particularly its regulator) and the public at large. Being able to demonstrate sound governance structure and systems, compliance with governing legislation, prudential requirements and best practices and thus transparency and accountability as an institution, is no longer a choice on the part of the regulated sector. Voluntariness has long been superseded by the practical imperative need for regulatory compliance in today’s financial world.

Any deviation therefrom has the potential for irrepressible adverse impact on the micro and macro- economic stability and the reputation of our country, thus heightens the need for every member of the regulated sector to be able to demonstrate regulatory compliance, more so now than ever before.

Against this backdrop, it bears underscoring that the FSA cannot fail to have a strong appreciation of its own role, responsibilities and accountability. Such awareness invariably tends to become even more intensified when adverse situations arise or desired results are not attained, even though it is commonly recognized that even the best of regulatory efforts cannot always prevent failed institutions or fraud. Thus, in awareness of the matrix of challenges which frequently arise, the FSA’s strategy and approach is reviewed on an ongoing basis, in order to continuously improve our results.

The FSA remains committed to working with the industry, stakeholders and fellow regulators, to ensure that mutual objectives of financial soundness, accountability, stability, sustainability and above all, the protection and preservation of fair treatment to consumers, are met.

Our Board Of Directors #

The Board of Directors, which is responsible for the overall coordination and strategic direction of the FSA, is comprised of experienced individuals in wide ranging fields of expertise, such as Finance, Accounting, Law and Insurance. The Board composition is as follows:

Kenneth Young – Chairman

Hance John – Accountant, Ministry of Finance and Economic Planning

Stewart Haynes – Actuary & Executive Director, National Insurance Services

Edmond Jackson – Director General, Finance and Planning Karen Duncan – Solicitor General

Carla James – Executive Director, FSA

Kozel Fraser – Resident Representative, ECCB

Susan Samuel – Financial Controller, Hotel Project Implementation Unit

Deidre Adams – Board Secretary, Budget Officer II, Finance and Planning

Our Management Team #

The FSA is headed by the Executive Director. The day-to-day business of the administration and management, together with the supervisory duties of the FSA, fall within this portfolio.

The statutory duties of the Executive Director are outlined in the Financial Services Authority Act, The Registered Agent and Trustee Licensing Act, the International Business Companies Act, the International Banks Act, the International Trusts Act, the Mutual Funds Act, and the International Insurance Act.

The management of the FSA is comprised of the following:

Carla James – Executive Director, FSA

Derek St. Rose – Deputy Executive Director, FSA

Keisha Bynoe – Manager, Finance and Administration

Karen Jackson – Manager, International Financial Services

Mintrue Rose-Providence – Manager, Insurance and Pensions

Nyasha Browne – Manager, Credit Unions, Building Society and Money Remittances

Legal #

The Legal Department of the FSA is responsible for providing relevant legal advice to the Authority and the public and the development and maintenance of appropriate legislative and regulatory framework informed by Government policy, supervisory and enforcement work, market changes and international initiatives and best practices.

A listing of our legal documents and forms can be found on our resources page.